Exclusive access to IPO and pre-IPO for your clients

Reliable liquidity platform for your brokerage business success

A new way to extend the life cycle and LTV of your clients

Opportunity to expand the customer base through the introduction of new instruments

Additional revenue stream for Brokers

Liquidity:

from startups to stock markets

With our help, you can get direct access to liquidity for all popular markets. Meros provides fast connection, development of your network and expansion of the audience for brokers and other financial companies

Access to the IPO and pre-IPO market for Brokers

Stocks liquidity

In addition to advanced pre-IPO and IPO instruments, Meros provides access to liquidity in classic market instruments. We provide reliable and fast access to major equity markets.

We have an independent, scalable platform, low commissions, access to US tech stocks at tight spreads, and more.

Maximize your offering, diversify your income and attract new customers with hundreds of instruments and limitless stock market opportunities

Our status and opportunities

As a Prime of Prime (PoP) provider, we offer services to Brokers, Banks, Hedge funds, Financial startups, Cryptocurrency projects and other companies.

Meros has a long history of successful investments in OTC and direct exchange markets, as well as a reliable technical base with the latest financial instruments.

We remove the barrier between large capital and retail markets, providing best deals with the necessary amount of liquidity

Large selection of assets

Hundreds of assets with information support from Meros specialists

Be among the major players

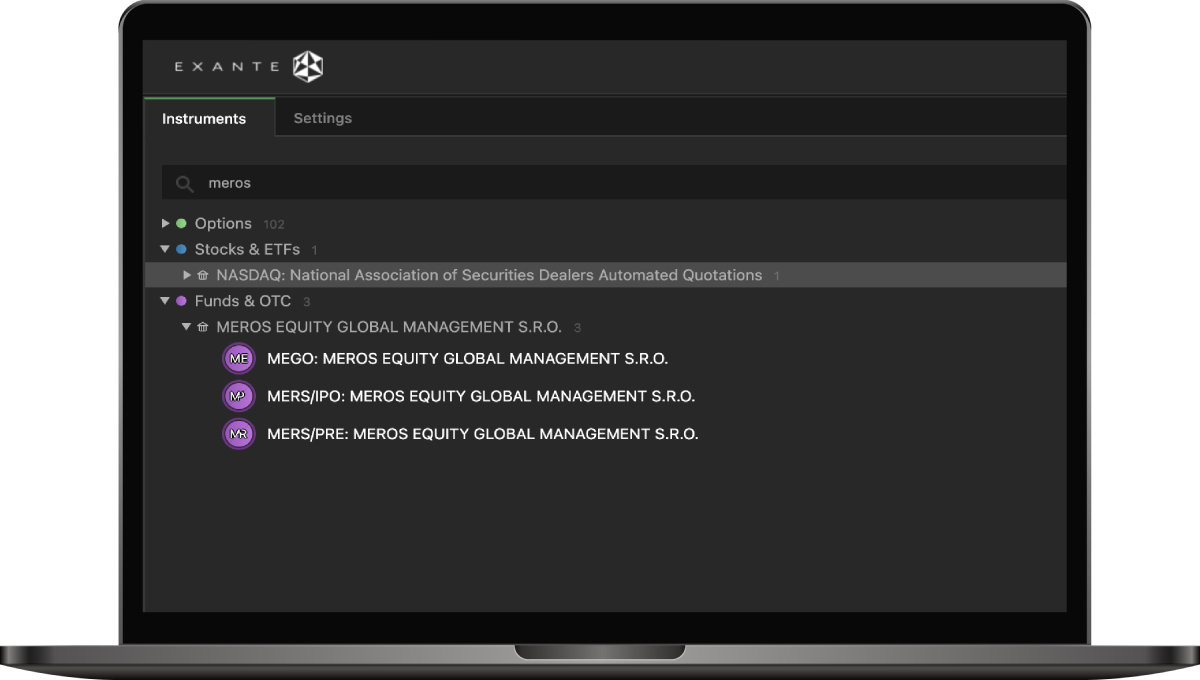

Meros first liquidity partner is one of the largest European brokers, Exante. Our solutions are also available to clients on the Exante platform with hundreds of thousands of instruments.

Meros technologies are highly regarded and are part of the ecosystem of the most innovative fast growing European broker.

Use our solutions to keep up with upcoming trends and always remain competitive.

Latest technological infrastructure

Meros uses the most modern trading solutions with the highest speed of execution and minimum latency

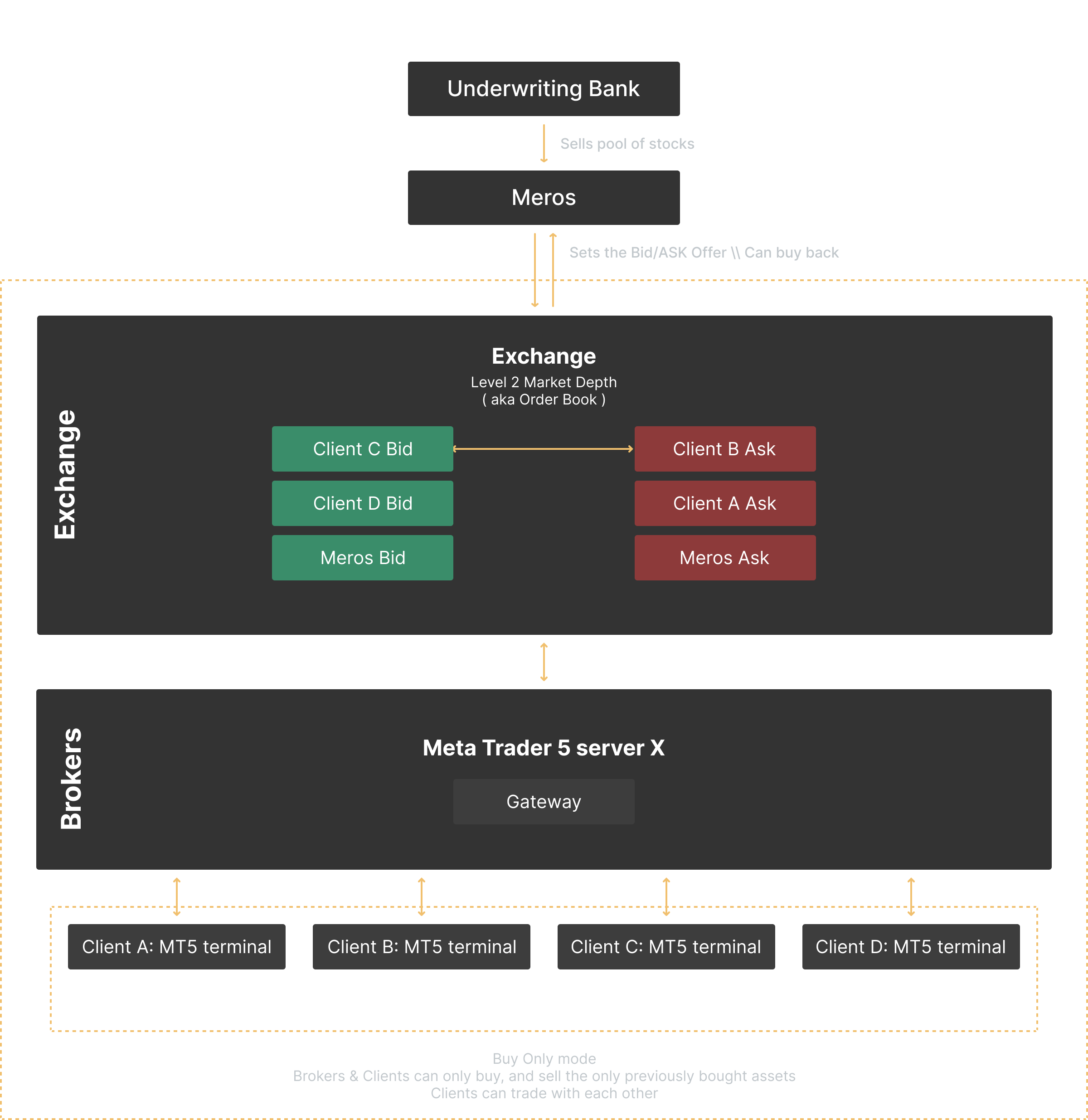

Connection via MetaTrader Gateway

Fast and resilient system that can handle peak demand during periods of market boom

Flexible settings and endless scaling options

Protection against common issues such as non-market quotes and latency arbitrage

Easy integration into any ecosystem of a Broker or other financial company

Connection via FIX API

Compatible with a wide range of trading platforms and capable of processing up to 250 price updates per second

Used when dealing with new assets such as open source cryptocurrencies

Reliable access to trading instruments for retail traders

Applied by leading institutional investors and major players such as Bank of America, Barclays, Credit Suisse

Benefits of the Meros Ecosystem

Liquidity for all businesses

Our solutions fit a wide variety of liquidity needs and business models. These are traditional financial services, as well as innovative trading services.

Broker

Brokers will get liquidity for the most instruments

Trade a variety of assets, including exclusives from OTC markets

The fastest possible order execution

The best prices that will make your business attractive to customers

Hedge fund

Tools to simplify work with a variety of strategies and non-traditional assets. Opportunity to earn income above the market average

Solutions for large and medium capital

Work with consultants to create personalized offers

Multiple asset classes and hundreds of trading instruments

Financial institutions

Access to liquidity for banks, financial technology startups and other organizations

Transparency of liquidity conditions and personalized approach

Technical support and assistance in creating a new business segment

A wide range of tools and reliable partnerships for long-term strategic development

Our platform makes business successful

See why our platform is the best path to effective trading tools

Access liquidity

Sign up for a demo-meeting or book an appointment for a convenient date and time