Pre-IPO or OTC — Over The Counter

Investments in highly profitable companies at the development stage

In this type of trading, the seller and the buyer make a direct transaction, bypassing the exchange. Meanwhile, small investments can bring maximum benefit.

Start investingTypically there are three rounds of investment in OTC and the lower the round, the less investment a startup needs

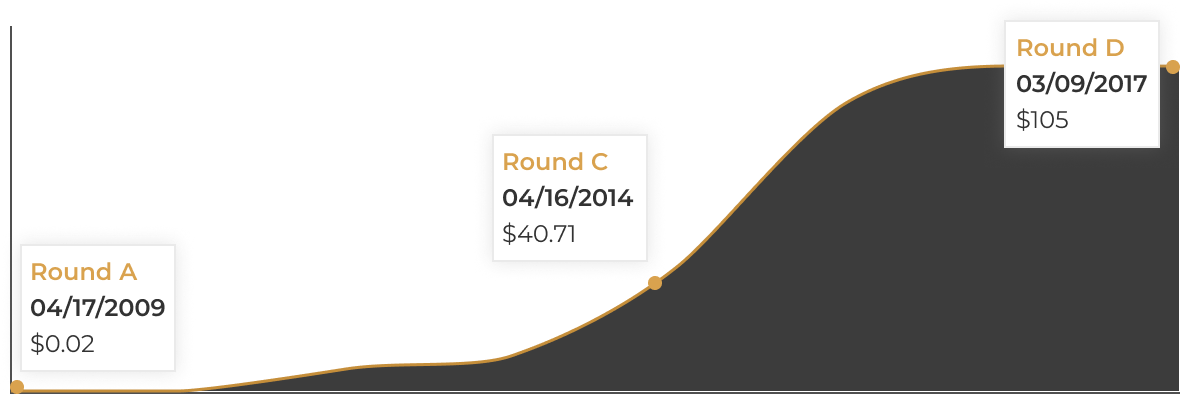

Airbnb shares have risen 5,000 times in 8 years. from $0.02 to $105. By investing $200, you become a millionaire. There's something to think about here

The startup is already mass-produced and has its own customer base. The main investors at this stage are venture funds. Startups are looking not only for financial support, but also for knowledge on how to build business processes and business relationships

The startup has proven its viability. The company scales up, enters new markets and gets the opportunity to lend to banks

The company has gained market share, is self-financing and generates stable income and it can be accurately measured, so the risk of investing in such a company is already much lower. At this point, the company may go for an IPO

How can an ordinary investor participate in a Pre-IPO?

You can participate in Pre IPO only through funds organized by management companies

They put together a group of multi-million dollar members and participate on their own, and you buy the equity of this fund. Pre-IPO participation threshold with Meros Equity from EUR 10,000

Currently, the fund is participating in Pre-IPOs with the following companies:

Offering price:

$80.43

Offering price:

$11.44

Offering price:

$44.20

Offering price:

$27.00

Meros criteria for the selection of companies:

Pre-IPO investments can be quite profitable, but nearly 100 million startups are launched worldwide yearly, with approximately 80% failing.

It is a complex market with many players and individual cases of bad faith among startup founders.

Therefore, it is essential to use specialists' support when investing in a pre-IPO.

We offer transaction support and the expert assessment of startups' innovative and commercial potential.

In Meros Equity we make investment decisions based on reports

–Standard & Poor's ( Manages the S&P 500 Index ). Their analysts' forecasts are realized by 84.7%

Currently, the fund is participating in Pre-IPOs with the following companies:

Sign up and invest in high yield Pre IPO deals

Spend 5 minutes to create your account and begin investing right after the registration